Each of us has multiple monthly payments to pay. Paying bills might often include deducting a significant portion of our wages to cover a variety of services that we require or imagine we require.

To be honest, I never enjoy paying bills. I am confident that none of you pay bills without considering how you might save or eliminate payments. There are various online bill-payment options accessible today. One of these services is Billshark.

Understandably, you’d like to know if Billshark is genuine and how much money you may save by using the service. As a result, I am writing an honest Billshark review. We’ll also explore if it can save you money on bills.

Let’s start by understanding what Billshark is. Later, I’ll explain how the system works, where you may use it, how much the service costs, and other specifics.

Understanding Billshark

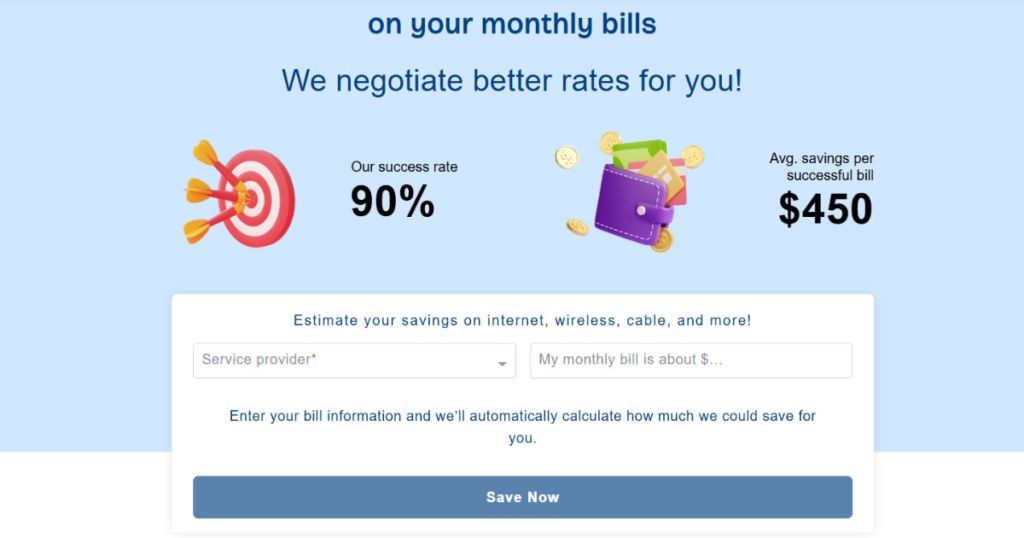

There are various online services that might help Americans save money on their monthly payments. Billshark is among these services. They claim you can save up to 25% on your monthly expenditures.

Billshark is an online bill negotiator. It implies that they negotiate your monthly payments with providers and assist you in obtaining a return for any amounts you have already paid. However, Billshark is not a free service. Instead, you will pay them some money. I will go into that later in this essay.

If you have multiple subscriptions that you aren’t utilizing or would like to cancel in order to save money, Billshark can help. This too is not a free service.

Overall, Billshark handles the negotiations for you. They negotiate with numerous service providers to recover some of your money back on bills you’ve paid.

Where Billshark Can Help

It’s crucial to realize that Billshark cannot assist you in bargaining and cutting your monthly grocery or petrol expenditures. Billshark also does not assist you in obtaining cashback on entertainment or food bills, or any other expenses that you may have.

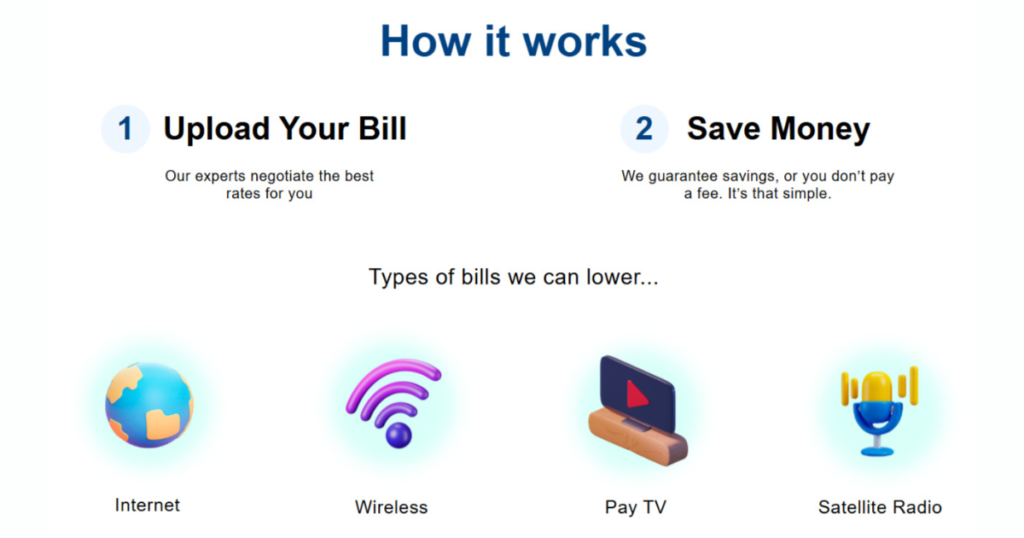

Here are some of the bills that Billshark can help you decrease or get cash back on after you’ve already paid them.

- Mobile phone and Internet services.

- Cable TV/Satellite TV with subscriptions.

- Landline phone.

- Internet Service Providers.

- Satellite radio.

- Subscription packages for TV, Internet, and phone.

It’s important to realize that Billshark cannot obtain you cashback or negotiate your bills if they are currently part of a unique and low-cost bundle or service. That implies that if you already have a special rate because you joined up during a promotion, Billshark services will be unable to assist you.

The good news is that Billshark collaborates with nearly every major mobile phone and Internet service provider, phone company, and other organization in the six industries listed above. The good news is that Billshark operates across the United States. They operate online, so you can get their services from anywhere in the country.

They are considered to have a 90% success rate when negotiating your bills. This means there is no assurance that you will receive cashback or pay less for a bill.

Cost of Using Billshark

As previously stated, there is no assurance that Billshark will help you secure a refund or cut your payments. They have negotiated thousands of bills until today. However, success is determined by a variety of circumstances, including your location, service provider, sort of service, and plan, among others.

Billshark has both a website and an app. You may get their app from Google Play for Android phones or the Apple Store for iPhones. It is free to register with Billshark and use its website or app.

However, Billshark keeps 40% of the money you receive as a refund. For example, if you pay $100 for a bill and Billshark negotiates it down by 25%, you should receive $25 back. However, given that Billshark keeps 40% of your cashback, you could only get back $15. Some clients claim to have received bigger amounts of money, while others complain that they only received $5 to $10.

Workings of Billshark

Using Billshark is very simple. Almost everyone who utilizes Billshark does so using the app, which is the most convenient. As a result, the best way to get started with Billshark is to download the app to your phone.

Once you’ve registered, fill out the data, such as which services qualify for bill reductions. These include your customer ID number, provider, monthly bill data, and other relevant information.

Choose the sorts of bills you want to save on and supply the necessary information. The app will notify you whether such service is accessible in your area.

When you see a bill, go to the Billshark app’s negotiations area. Use the Billshark app’s scan or photo capability to upload your bills. Once you’ve uploaded the bill, you must pay it using the app, your net banking, credit card, or debit card.

Once paid, Billshark will attempt to negotiate your bill and payment with the service provider. If possible, they will try to obtain a payback on the amount you have paid. This money is returned to your original payment method, like a credit card, debit card, or bank account.

Canceling Your Subscription

Billshark charges $9 to terminate a subscription and make a last payment. This feature is, however, only available for certain memberships. That is, if you are in a long-term contract with any service provider for a minimum charge, you may not be able to terminate the subscription via Billshark. This may also be determined by your location and service provider.

In rare situations, Billshark can also assist you in negotiating a final bargain to cancel a subscription. In such circumstances, the highest you might pay is $9. I recommend that you read Billshark’s terms and conditions before proceeding with subscription cancellation. There is a chance that you will be able to arrange a cancellation with the provider directly.

Insurance Through Billshark

You can also use Billshark to acquire or renew insurance. Billshark does not charge any fees. Instead, the agreement is solely between you and the insurer. Billshark serves merely as a mediator, offering an additional service to attract customers.

Before purchasing insurance with Billshark, you can check pricing for several plans online. You can also negotiate payments for these insurance plans with the insurer’s agents. Most insurers expect a client to bargain and, hence, have some margin to supply a plan at a lower cost.

Also Read:

Conclusion

These are all of the things I learned about Billshark while researching various websites. As a result, I can confidently state that Billshark is legitimate and does bring some relief by offering rebates and price reductions on bills that you must pay. They can also help you save money by canceling your memberships. However, the 40% charge is a bit too much. However, given that you would lose all of your money if you did not use Billshark, receiving something back is worthwhile.